Oasis Network (ROSE) Price Forecast for the End of 2025: Key Insights and Analysis

The content in this article is for informational and educational purposes only and should not be considered financial advice. Cryptocurrency investments involve significant risks.

Introduction

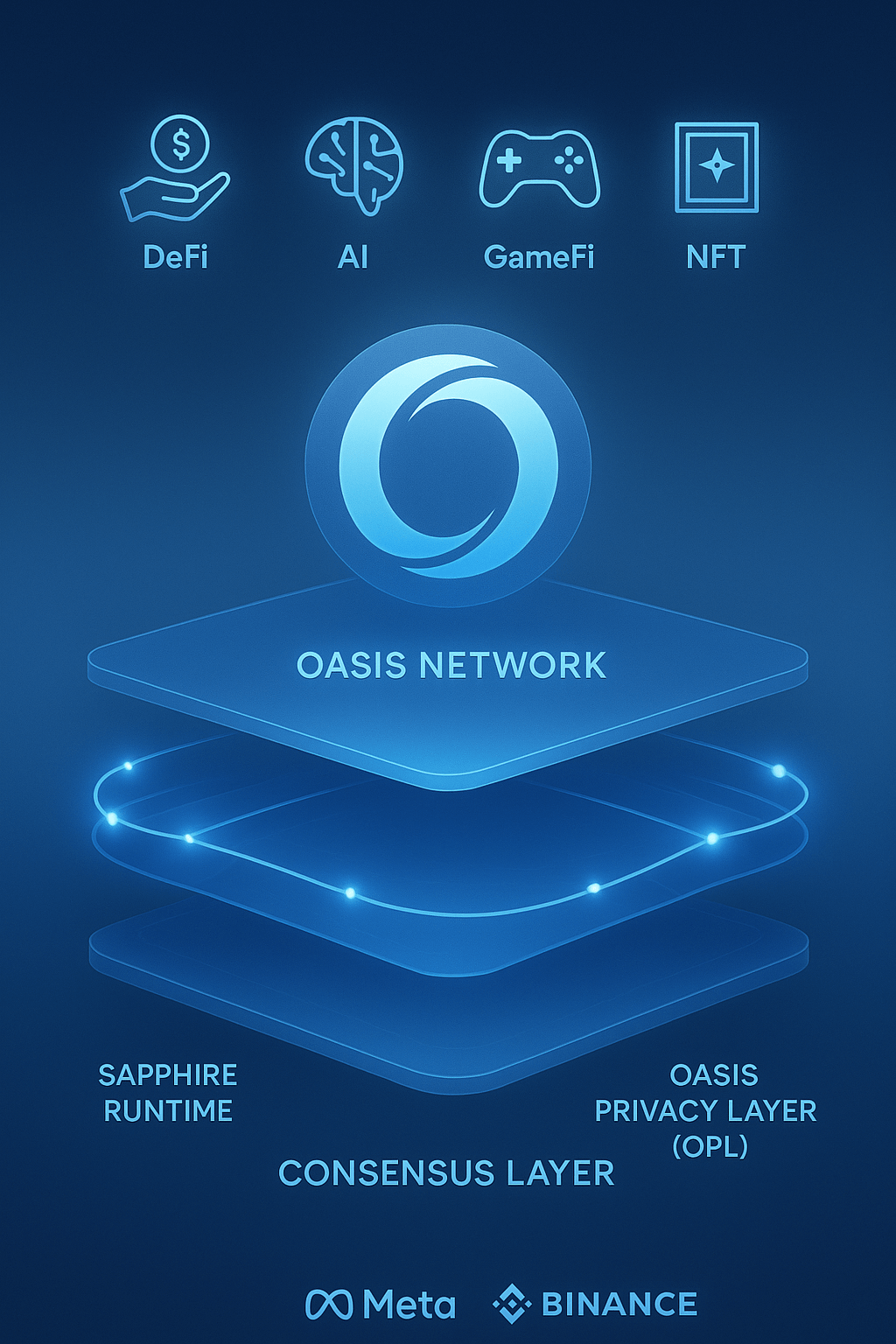

As of August 26, 2025, the ROSE token is trading at approximately $0.02574. Oasis Network is a private Layer 1 blockchain, launched in November 2020. The platform is known for its scalable, modular architecture with separated consensus and compute layers, ensuring high performance. Oasis supports private DeFi, AI, GameFi, and NFT applications through the Sapphire execution environment and the Oasis Privacy Layer (OPL). The circulating supply of ROSE is about 7.41 billion tokens (out of a total issuance of 10 billion), and the market capitalization is approximately $190.7 million (ranked about 239th among coins). The ROSE token is used for gas fees, staking, and network governance. This article provides a detailed analysis of the price prospects for ROSE by the end of 2025, including bullish and bearish scenarios, growth drivers, and risks based on current market trends and the development of the Oasis ecosystem.

Current Situation

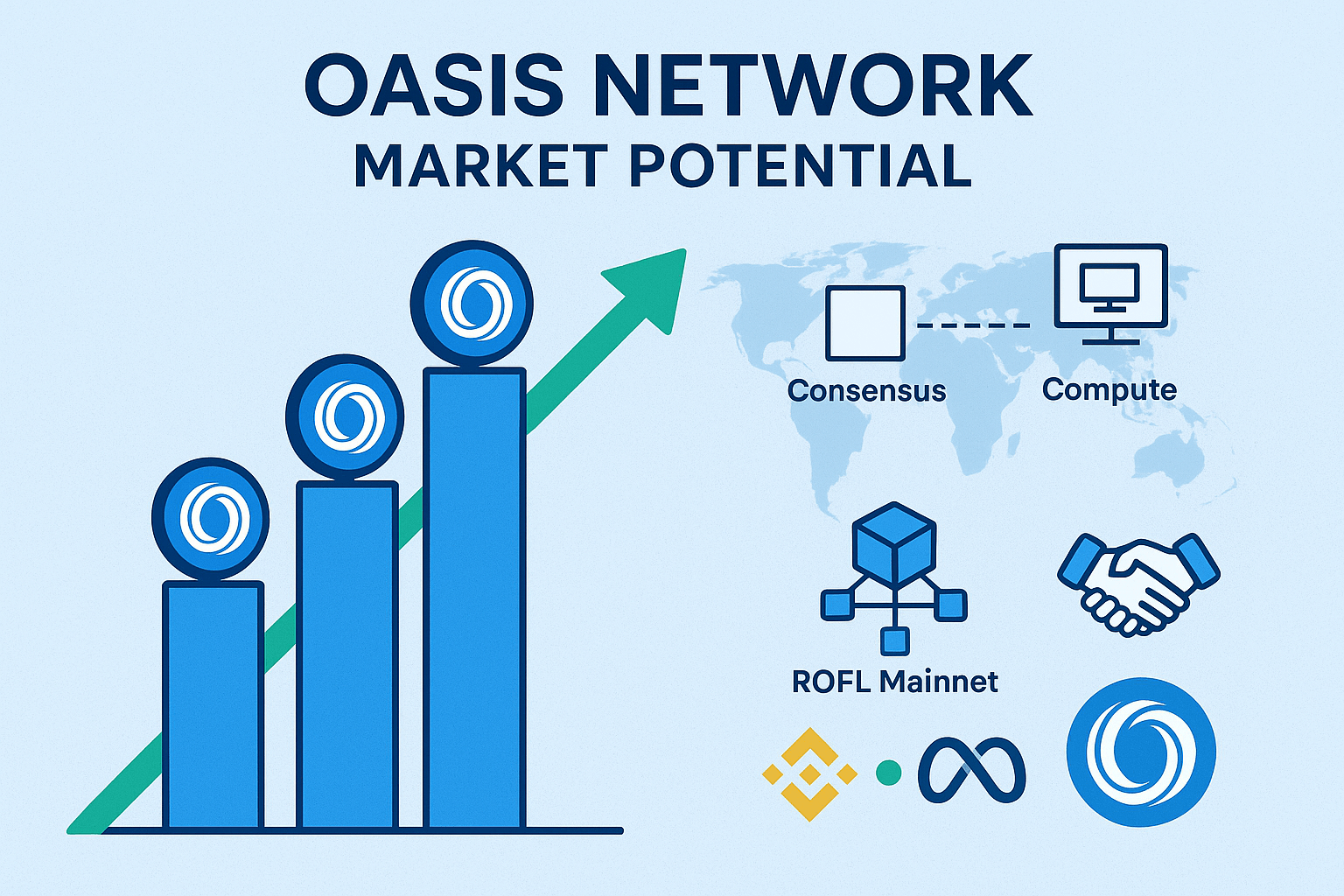

On August 26, 2025, the price of ROSE is around $0.02574, which is up by 0.55% over the last 24 hours but down by approximately 8% over the past week. The daily trading volume reaches about $10.36 million. Technical indicators show a mixed picture: the 50-day Simple Moving Average (SMA) is rising (indicating short-term bullish momentum), while the 200-day SMA has been declining since mid-July (long-term weakness). The crypto market's Fear and Greed Index stands at 73 ("greed"). Over the last 30 days, 16 days concluded as "green," and volatility was approximately 9%. Recent updates to the Oasis ecosystem—the launch of the ROFL mainnet and the resumption of trading for the ROSE/USDC pair on Binance—are also fueling optimism among market participants.

Price Predictions for End of 2025

Analysts' forecasts for the ROSE price by the end of 2025 vary widely due to high market volatility and differing valuation approaches. The following scenarios are considered:

| Scenario | Price Range by End of 2025 |

|---|---|

| Bearish Scenario | Approximately $0.0037–$0.0327 |

| Moderate Scenario | $0.1169–$0.331 |

| Bullish Scenario | Potentially $0.4642–$0.9213 |

Overall, most forecasts point to a price range of approximately $0.12–$0.27 by the end of 2025. In the optimistic case, with a strong bull market, the ROSE token could exceed $0.40.

Factors Driving Price Growth

- Privacy Technology: The launch of the Sapphire runtime and the Oasis Privacy Layer enables the creation of private DeFi and AI applications on the platform, increasing the attractiveness and demand for the ROSE token.

- Ecosystem Improvements: The launch of the ROFL mainnet and integration with Metamask Snaps simplify interaction with wallets and applications, attracting more developers and users.

- Market Rally Potential: The expected growth of the crypto market in early 2025 (especially if Bitcoin holds above $100,000) could push the price of ROSE upward along with other altcoins.

- Community and Grants: Grant programs for new projects (e.g., Tradable and Zeph) and the expansion of the number of validators (around 112 on the mainnet) strengthen the ecosystem and support network development.

- Exchange Availability: The resumption of trading for the ROSE/USDC pair on Binance increases the token's liquidity and simplifies investor access to ROSE.

Risks and Downward Factors

- Market Volatility: A possible sharp correction (30–40%) in early 2025 could significantly lower the price of ROSE. A decline of about 3% was noted in the last month amid general market pressure.

- Regulation: Private blockchains may face stricter regulatory requirements. Increased scrutiny from regulators could limit the listing of privacy-focused cryptocurrencies and dampen investor interest.

- Competition: Other private cryptocurrencies (Monero, Zcash) and scalable blockchains compete for investment and users, which could divert some demand away from Oasis.

- Technical Risks: Failures during the implementation of new updates (e.g., ROFL) or insufficient community support could undermine investor confidence and lead to a capital outflow.

Volatility Analysis

From July to the end of August 2025, the price of ROSE declined from ~$0.03036 to ~$0.02574 (approximately 15%), reflecting increased selling and high volatility (about 9% over the last 30 days). The current RSI is around 63 (neutral trend). The key support level is approximately $0.0229, and resistance zones are around $0.0335–$0.0441. The 50-day SMA continues to rise, indicating short-term buyer pressure, while the 200-day SMA is steadily declining (long-term weakness). A descending wedge has formed on the hourly chart—an upward breakout from this pattern could push the ROSE price to ~$0.1066 in the short term. However, if the price fails to overcome resistance, a pullback to the $0.0229 support level is possible. Oasis's focus on privacy and ecosystem expansion creates a foundation for ROSE's recovery, but short-term bearish pressure remains high.

Conclusion

By the end of 2025, most analysts expect the price of ROSE to be in the range of approximately $0.12–$0.27, and in a favorable scenario, up to $0.40–$0.4642. Investors should account for high market volatility, regulatory risks, and competition in the private blockchain space. Before investing, it is recommended to conduct your own research on the project and manage risks appropriately. More detailed information about the Oasis Network ecosystem can be found on the official Oasis Protocol website.